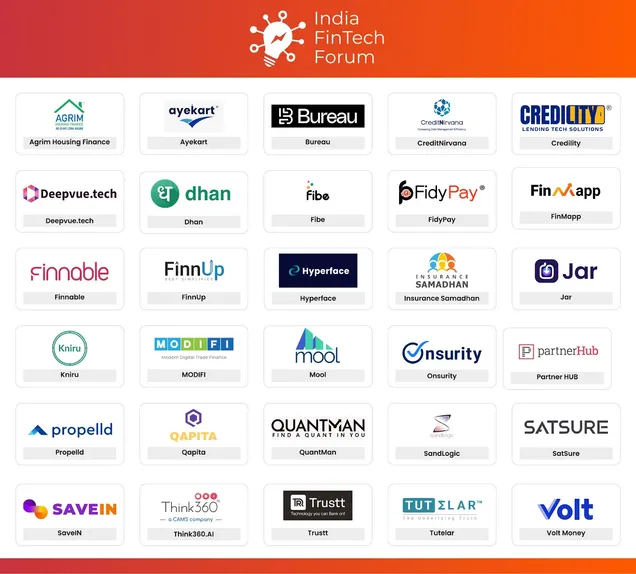

Jar and Mool are the only familiar names…

Onsurity - used by Jupiter for health insurance.

Dhan: Stock market app just like Grow without an account opening charge or AMC

Jar: Save in gold through SIP

Onsecurity: Health insurance provider; used by Jupiter

Save-in: Loan product

Fibe : Instant personal loan ![]()

Yes, but they are shortlisted for another category as per the article

Fibe provides short term instant loans and EMI purchase facilities

Hyperspace looks interesting ![]()

Check out Vegapay. Upcoming competitor to Hyperface with more robust stack.

"According to the company, it has reduced its customer acquisition cost by around 80 percent over the past four years.

The credit card bill payment firm has seen its marketing expenses go down by 27 percent to Rs 713 crore in the fiscal ending March 2023, from Rs 976 crore in FY22.

CRED’s expenses grew to Rs 2,832 crore in FY23, a 66 percent increase over the Rs 1,702 crore reported in FY22."

Acko revenue crosses Rs 1,750 Cr in FY23, losses surge 53%

https://entrackr.com/2023/10/acko-revenue-crosses-rs-1750-cr-in-fy23-losses-surge-53/

“On the cost side, claims paid to the customers were the largest cost center and accounted for 31.6% of the overall expenditure. This cost surged 67.2% to Rs 801 crore in FY23.”

“Overall, the country is the third largest startup ecosystem globally with nearly 1 lakh startups, behind the US and China.”

“Alternative Lending, in particular, clocked a remarkable growth of 259 per cent compared to Q2 2023, reaching $305 million in funding. The BNPL (buy now pay later) sector which has seen significant growth and adoption within the country contributed to the growth in this sector. “In a time of global economic uncertainty, India’s fintech sector has demonstrated exceptional resilience and growth,” said Neha Singh, Co-Founder, Tracxn.”

“Industry experts say it is profitable for a brokerage to have fewer investors who trade daily than having a large number of investors who trade once in a while.”

“According to NWKRTC officials, in the month of September, 9,274 (14 per cent) passengers used the UPI payment facility to get tickets, and the corporation did Rs 21.55 lakh (12 per cent) transaction through UPI payment. As the payment facility is introduced on long-route and executive buses, many passengers book their tickets well in advance, while only a few passengers buy tickets onboard, they noted.”

“The conductor carries a card displaying the QR card. The passengers can scan the code through any UPI payment app to make the payment. Soon after the payment, the conductor gets the payment confirmation through voice message on his mobile phone and he issues the ticket. Even in the ticket, it is mentioned ‘UPI payment ticket’.”

Well, if you ask me the valuation of companies don’t make any sense. They look at the possibility of a highly profitable company in the future and not what are the company financials right now.

Can someone help me understand who actually gives the valuation for the companies based on the investments? Sometimes it’s 10 times the investment round.

"China and India, rank first in the ranking of countries with the highest financial technology adoption rate. As of 2019, 87% of China’s digitally active population has adopted fintech.

Tied with China, India also has an 87% adoption rate. As Tipalti explained, between 2021 and 2022, India had around 6,600 financial technology startups with a total market value of US$31 billion. In the first half of 2023, investment in financial technology startups in India fell by 67%.

Despite this drop, it is the third highest-funded fintech country in the world, behind only the United States and the United Kingdom."

Valuations are a very subjective matter, depends on team to team just like PE.

lag gaya to tees-markhan warna…

Interesting listen… They call it the “Back-Door Entry into Banking for Slice”. ![]()

It is a back door entry. I read in an article in ET where the RBI states that this just an NOC and not an approval and the merger will have not go through the usual approval route. Plus RBI has not changed it stance Fintech getting banking license which is extremely hawkish

What I think is maybe RBI doesn’t want the situation to get worse like in the case of Yes Bank and so they may have thought of giving it to Slice and have an overlook on how things go.

Anyways Small Finance Banks have their own criteria for keeping their licenses.

@alexnazy Might be. I was also thinking along the same lines. If this is true, the RBI may apply the same logic to the Zerodha-Nainital bank and other upcoming partnerships.

At the end of the day, RBI wants compliance, and with slow banks as a hook, fintechs would come in the circle of compliance and reporting and not to forget digital india for all.

I am actually hoping that this is a good thing.

If all goes well, the new age Fintechs would infuse latest technology and processes into the Banking sector.

Imagine Jupiter merging with a bank and becoming its own bank. I would love that and I am sure most of the banking sector problems would go away.

But a new problem will be born for Fintechs through this. Regulations…

Right now the Fintechs leave the regulations to the banks and focus on the tech stack. But when they become banks, they can’t escape the RBI oversight.