Now, it’s charges 2.95%

That will be used for shopping ![]() . If Jupiter doesn’t want to provide free card and prefer to spends. It can at least provide prepaid virtual cards to those who do not want to pay a single penny as card charges. If one wants the debit card to be used for online transaction purpose only and wants to pay minimum charges then Visa Classic with 25+GST annual charges would be a good option.

. If Jupiter doesn’t want to provide free card and prefer to spends. It can at least provide prepaid virtual cards to those who do not want to pay a single penny as card charges. If one wants the debit card to be used for online transaction purpose only and wants to pay minimum charges then Visa Classic with 25+GST annual charges would be a good option.

even rupay is better in this case if it’s free

Dinesh, while the idea is interesting, there are product offerings available in the market that serve the same purpose and offer better offers. One such platform that I am aware of is Hubble.

Dinesh, is not for the virtual card offering. It is to maintain the debit card on Federal Bank’s system. As confirmed by Tanvi in the thread for the debit card charges, Federal Bank considering a virtual card as full fledged debit card.

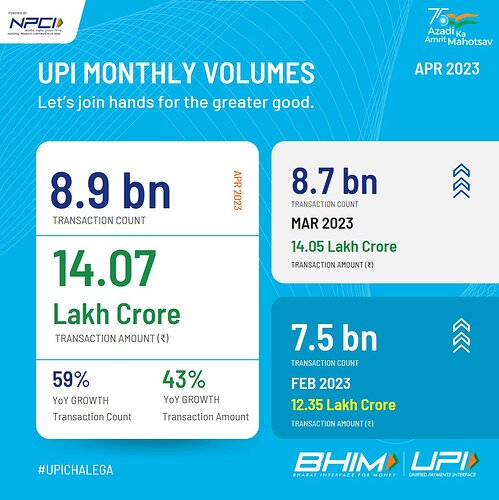

In April 2023, the UPI transaction count in India reached a staggering 8.9 billion, registering a YoY growth of 59%.

The transaction amount also witnessed a notable increase, amounting to Rs. 14.07 lakh crore in April 2023, a YoY growth of 43%.

Source: NPCI

As and when, Credit on UPI and Credit Card on UPI start picking up, these numbers will only become more and more staggering.

Really UPI is game changer, a national giving free transactions too much easy fast and secure… ![]()

However, it’s not completely free, the government have to pay the cost

I know that… It’s a service like Indian Railways…

1k cr is nothing for gov compared to collected indirect taxes like gst .

Niti ayog and planning department too much intelligent… They open zero balance account for all, give them free rupay card … Then introduce upi … Npci’ s imps is also good but now it’s costly… After demonetisation upi growing up… Now it’s normal for everyone… As compared visa and others global payments system it’s too much advance secured and easy… Even cost is too much low for maintenance.

I’m just point out the cost, as many people believe that UPI transactions are entirely free, they can’t see the hidden costs associated with the technology infrastructure and maintenance, which may be borne by the government or the other entities involved in the transaction process.

Also, while 1000 crore may not be a large sum of money for the government, it is crucial to acknowledge that every rupee counts, particularly when it comes to public funds.

UPI is now free but not in future… It’s a great step for growing up India in digitization… Jio introduce to people low cost internet and upi giving them faster and safest transactions …

Some years ago payment to much complicated… Buying using Card need pos it’s too much costly… And time taking… Now upi … Before ecom transactions need card details… Now upi… Before money transfer need account number, name, IFSC, mmid … And need net banking… Login… Too much complicated and also charges high… Now upi ![]()

Pratyay, 1K crore if not subsidised can be utilized for investing in other avenues eg, ifrastructure development. The processing fee waiver that we receive is the government’s investment in the payment processing network.

Sani, as per the RBI & finance ministry, UPI is considered to be public welfare initiative and will continue to remain free for users for the foreseeable future.

I didn’t think soo … Banks and financial institutions are not interested about that… Even if they give free many banks and private UPI app can charge you

Can charge and will charge are 2 different scenarios. As of now, the only UPI transactions that attract a fee are the ones made from PPI instruments and that too users are not required to pay for it.

isn’t upi based on imps