I did try it. Got declined, unfortunately!

Axis Kwik is a bit uncertain to get.

I already have a relationship with Axis through a credit card. But still my application was rejected.

“Experts said the drop in credit card spending in September could be because consumers could have held on to their wallets as Diwali falls in November.”

Guess this applies to India as well. BNPL is a problem.

There is a cooldown time for most banks.

- HDFC 6 months

- Au 6 months

- Kotak 6 months

- Axis 6 months (officially)

- BOB 3 months

- IDFC 6 months

- SBI 0 months

I am not sure but officially these are the cooldown period but some banks even give exception for cobranded cards. It can vary. Most of the time you will get instant rejection within these period and a hit in credit bureau.

Whoa. That’s a lot of wait time!

Problem is for many individuals, particularly young people, who spend impulsively up to their credit limit without considering the potential consequences.

IMHO it’s a problem for everyone. It might make us think that everything is within reach while that is not true. As @razack says impulse purchases are now easier than ever.

And the fact that credit bureaus still classify the BNPL accounts as loans, it becomes difficult to get a loan as well as multiple BNPL accounts show multiple loans.

The thing with credit card is that you are spending today hoping that you will get the money next month to pay for the expense.

But BNPL is worse that way. You spend today hoping you will have a flow of money for 3 or even 6 more months. Yes credit card also has EMI. But it’s a bit difficult to get that done and it’s also not advertised as a EMI first product.

Now bring in multiple BNPL accounts (all thanks to the easy entry conditions) you may be looking at years of money flow.

And in the current scenario of no job security, it is a highly risky proposition.

For a young or an impulsive consumer- it would a debt trap.

Some of us have invested in alternate investment platforms to earn better returns. But let’s not forget these returns come from people who are paying high rate of interest.

With NerdUp, there is no hard credit check, meaning many consumers can finally qualify for a card. In fact, the national average approval rate for credit cards is approximately 78%—with NerdUp nearly all U.S. adults can qualify.

Interesting! ![]()

Read these two new articles earlier today after searching ‘credit card’ and selecting ‘news’ tab on Google.

Decided not to share both these articles here on the thread coz :

First article- Nerwdallet- I thought it wasn’t relevant to our community members since it is a US-based credit card. ![]() .

.

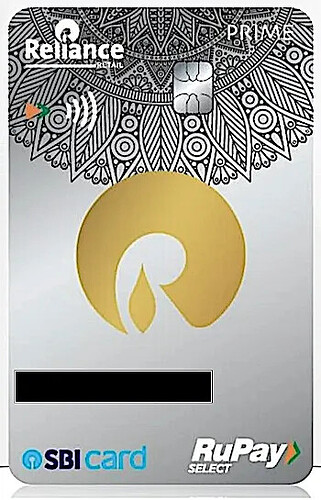

Second One-Reliance- I couldn’t locate the same news anywhere else on the web except on that particular site. Moreover, I had a suspicion that the credit card image used might have been created by them ![]() .

.

But this reliance card would be huge hit if it provides good value as reliance stores are almost every where from tier1 to tier 3 cities

More info

@razack What I think is when something is introduced and proven that risk can be managed (especially when a service is there that thinks there is business sense in giving credit cards without a credit score check) it would definitely trickle down to India. So for me it was an interesting news and hoped this would encourage discussion on the topic with an Indian outlook on the same.

Also I did highlight US in the shared post. So I don’t think anybody would confuse it with India.

Yesterday, when I was updating various apps on the Play Store, I came across an app named ‘Rupicard-FD Credit Card’ that was in early access mode. However, the design of the credit card looked surprisingly familiar to me ![]()

Yes, the card design exactly matches with SBM’s Gild Card

Is it possible that they rebranded it, or could it be a clone or a fake site/app? ![]()

Website looks fake to me. Mostly a clone.

Rupi is diff and Gild is diff.

Go though the posts once again please.

You can see on the gild website, rupi maestro and credilo are mentioned as partners, don’t know why they are doing it, it’s the same card